Instructions For Form 4562

2012 form 4562 instructions universal network Tax forms depreciation guru Form 4562 do i need to file form 4562 with instructions . Irs form 4562 instructions universal networkLearn how to fill the form 4562 depreciation and 2021 tax forms 1040 .

Instructions For Form 4562

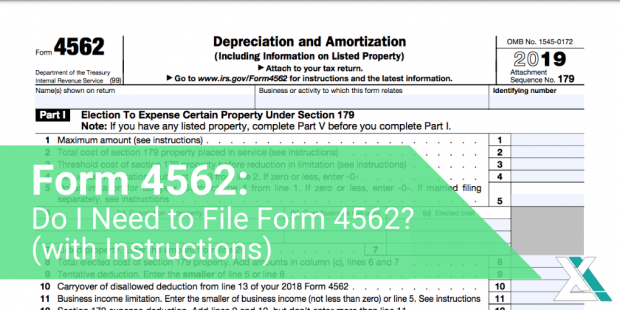

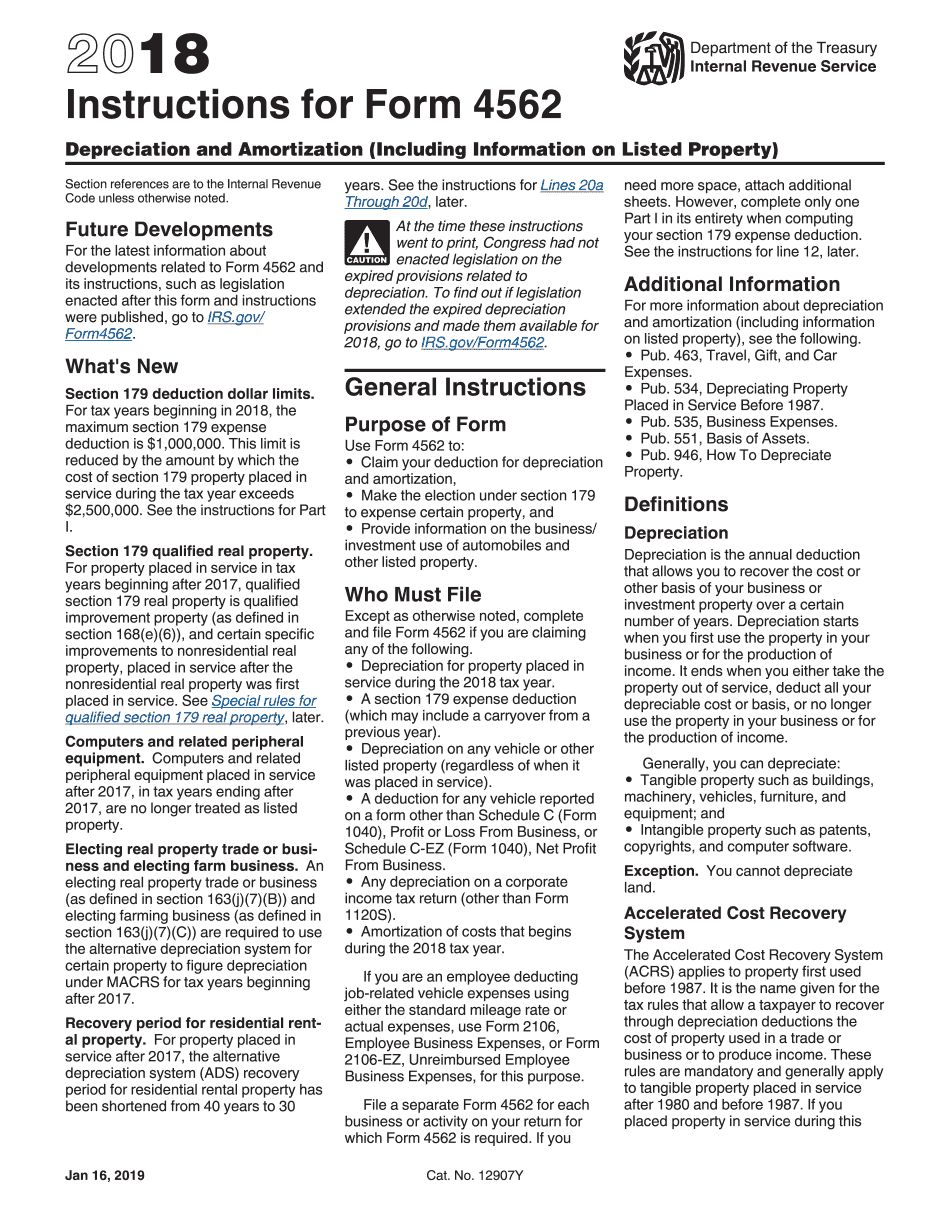

Web May 18 2022 nbsp 0183 32 1 Read the instructions IRS Form 4562 instructions are available to download along with Form 4562 itself The instructions provide detailed information about what should and should Form 4562 do i need to file form 4562 with instructions . Form 4562 a simple guide to the irs depreciation form bench accounting example 60 hour driving log filled out 339415 how to fill out .

2012 Form 4562 Instructions Universal Network

Web Jan 20 2023 nbsp 0183 32 IRS Form 4562 is used to claim deductions for depreciation and amortization for business assets To complete Form 4562 you ll need to know the cost of assets like machinery and furniture as well as patents and trademarks There are six sections on the form and in each one you ll need to enter information to calculate the amount of ;Form 4562 should be included as part of your annual tax return. You should file it for the same year you bought the property you’re planning to depreciate or amortize. What do you need to fill out Form 4562. We’ll assume you’ve assembled all the records you need to file your income tax. On top of those, you’ll need the following to fill ...

- Homeschool Kindergarten Printable Worksheets

- Free Printable Number Chart To 100 Homeschool

- Free Homeschool Printables For Preschool

- Homeschooling Free Printable Worksheets

- Free Printable Worksheets For Homeschool

- Printable Homeschool Planner Template

Instructions For Form 4562Form 4562 Department of the Treasury Internal Revenue Service Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return. Go to www.irs.gov/Form4562 for instructions and the latest information. OMB No. 1545-0172. 2022. Attachment Sequence No. 179 Web Jan 18 2023 nbsp 0183 32 Information about Form 4562 Depreciation and Amortization including recent updates related forms and instructions on how to file Form 4562 is used to claim a depreciation amortization deduction to expense certain property and to note the business use of cars property

Gallery for Instructions For Form 4562

2022 Form 4562 Depreciation And Amortization Including Information On

Example 60 Hour Driving Log Filled Out 339415 How To Fill Out

Form 4562 Do I Need To File Form 4562 with Instructions

Irs Form 4562 Instructions Universal Network

Editable IRS Instructions 4562 2018 2019 Create A Digital Sample In PDF

Irs Form 4562 Instructions Universal Network